Introduction

If you’re thinking about joining a 529 plan, or if you’ve already opened an account, you might be concerned about how 529 funds will affect your child’s chances of receiving financial aid. Of all the areas related to 529 plans, financial aid is perhaps the one that’s most subject to change. But here’s where things stand now.

Investors should consider the investment objectives, risks, charges, and expenses associated with 529 plans before investing. More information about specific 529 plans is available in each issuer’s official statement, which should be read carefully before investing. Also, before investing, consider whether your state offers a 529 plan that provides residents with favorable state tax benefits. As with other investments, there are generally fees and expenses associated with participation in a 529 savings plan. There is also the risk that the investments may lose money or not perform well enough to cover college costs as anticipated.

What is financial aid?

Financial aid is money given to a student to help that student pay for college or graduate school. This money can come from the federal government or the college and may consist of one or more of the following:

- A loan (which must be repaid in the future)

- A grant (which doesn’t have to be repaid)

- A scholarship

- A work-study job (where the student gets a part-time job either on campus or in the community to earn money for tuition)

The typical financial aid package contains all of these types of aid.

The federal government and colleges will look at your income and assets when measuring financial need. The federal government uses a formula called the federal methodology and private colleges use a formula called the institutional methodology.

The federal methodology and 529 plans

Under the federal methodology, 529 plans (college savings plans and prepaid tuition plans) are classified as an asset of the parent, if the parent is the account owner. So, if you’re the parent and the account owner of a college savings plan, you must list the value of the 529 account as an asset on the Free Application for Federal Student Aid (FAFSA). Under the federal methodology, a parent’s assets are assessed (or counted) at a rate of no more than 5.6%. This means that every year, the federal government says that 5.6% of a parent’s assets are available to pay college costs. By contrast, student assets are assessed at a rate of 20%.

There are a few special rules to keep in mind about the classification of 529 plans for federal financial aid purposes.

For parent-owned 529 plans:

- A parent must list a 529 plan account as an asset on the FAFSA only if he or she is the account owner. If a grandparent or other person is the account owner, then the 529 plan does not need to be listed on the FAFSA. In addition, any student-owned or UTMA/UGMA-owned 529 account is also considered a parental asset and reported as such on the FAFSA if the student files the FAFSA as a dependent student. (A 529 account is considered an UTMA/UGMA-owned account when UTMA/UGMA assets are transferred to a 529 account.)

- If a parent’s adjusted gross income is less than $60,000 and a few other requirements are met, then a parent will not need to report any assets on the FAFSA. So in this case, a 529 plan wouldn’t affect financial aid eligibility at all.

- Distributions (withdrawals) from a parent-owned 529 plan that are used to pay the beneficiary’s qualified education expenses aren’t classified as either parent or student income on the FAFSA, so they don’t affect financial aid eligibility.

For grandparent-owned 529 plans:

- Grandparent-owned 529 plans do not need to be reported on the FAFSA.

- Distributions (withdrawals) from a grandparent-owned 529 plan no longer need to be reported on the FAFSA as student income. Prior to the 2024–2025 school year, distributions from a grandparent-owned 529 plan had to be reported as student income the following year and were assessed at 50%.

The federal methodology and other college savings options

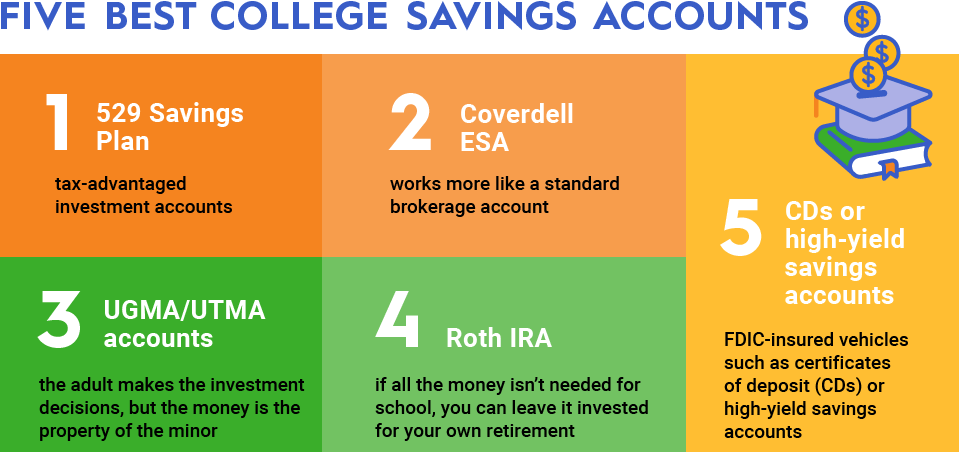

How do other college savings options fare under the federal methodology? Coverdell education savings accounts, mutual funds, and U.S. savings bonds owned by a parent are considered parental assets and counted at a rate of 5.6%. However, UTMA/UGMA custodial accounts and trusts are considered student assets and assessed at a rate of 20%.

Also, distributions (withdrawals) from a Coverdell ESA that are used to pay qualified education expenses are treated the same as distributions from a 529 plan: distributions aren’t counted as either parent or student income on the FAFSA so they don’t affect financial aid eligibility.

The federal methodology excludes some assets entirely from consideration. These include all retirement accounts (e.g., traditional IRAs, Roth IRAs, employer-sponsored retirement plan), cash value life insurance, home equity, and annuities.

The institutional methodology and 529 plans

Colleges aren’t required to use the federal methodology when they distribute financial aid from their own endowment funds. Instead, they typically use a common formula referred to as the institutional methodology. Generally, the institutional methodology digs deeper into your financial situation than the federal methodology to determine what your family can afford to pay.

The institutional methodology generally treats 529 plans, both college savings plans and prepaid tuition plans, as a parent asset. When funds are withdrawn from either type of plan, the institutional methodology typically treats the entire amount (contributions plus earnings) as student income.

Note: Like the federal government, colleges count a 529 plan as a parental asset only if the parent is the account owner. If the parent owns several accounts for different children, it’s not clear whether all of the accounts would need to be listed, or only the account where the current student is named as the beneficiary. Schools may vary on their treatment.

This content has been reviewed by FINRA.