Introduction

Let’s face it, we’ve all been there. You see a friend’s vacation pictures on social media and think, “If only I’d saved more…” Or maybe a co-worker mentions their impressive investment returns, and you’re hit with a wave of “what ifs.” Financial regrets are a common experience, but dwelling on them won’t change the past. The good news? You can transform those regrets into powerful lessons that propel you towards a brighter financial future.

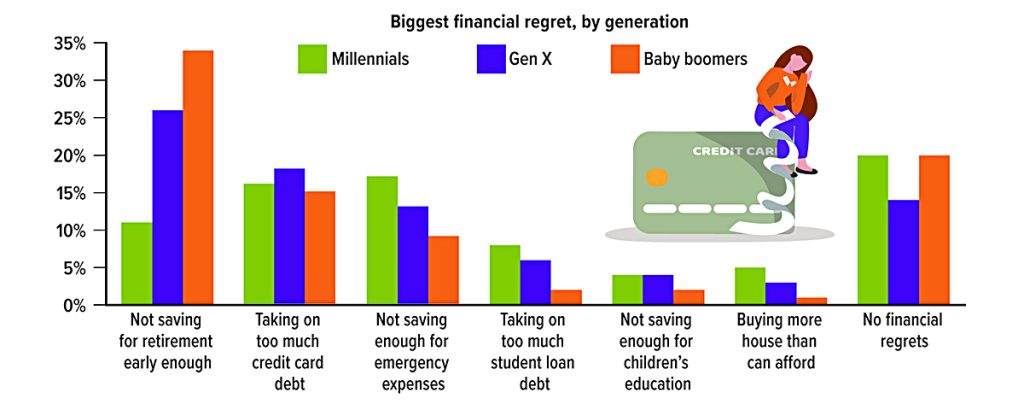

- A 2023 survey found that about three out of four U.S. adults had a financial regret. The most common were not saving for retirement early enough, taking on too much credit card debt, and not saving enough for emergency expenses. It’s probably not surprising that the weight that people placed on these and other regrets varied by generation — and regret about not saving early enough for retirement was higher for those closer to retirement age.

Common Financial Regrets

Financial regrets are common, with many individuals reflecting on past decisions that negatively impacted their financial health. Here are some of the most frequent financial regrets:

- Not Saving Enough: A major regret among Americans is not saving adequately for emergencies, retirement, or other financial goals. This lack of savings can lead to financial insecurity and missed opportunities .

- Excessive Spending and Debt: Many regret overspending and accruing substantial debt, which can create long-term financial strain and limit future opportunities .

- Missed Investment Opportunities: Failing to invest or not investing early enough is a common regret. Missing out on the potential growth that investments offer can significantly impact long-term financial health .

- Not Planning for Retirement: Many people regret not having a solid retirement plan, which can lead to financial challenges in their later years [6].

- Housing Decisions: Upgrading homes too quickly or not buying a home when prices and interest rates were favorable are common regrets. These decisions can impact long-term financial stability

Taking Control of Your Finances

Here are some resources to equip you on your financial journey:

- Free Budgeting Apps: There are numerous budgeting apps available to help you track income and expenses, and create a personalized spending plan.

- Financial Literacy Websites: Government websites and reputable non-profit organizations offer a wealth of information on personal finance basics, investing strategies, and debt management.

- Financial Advisors: Consider consulting a professional financial advisor for personalized guidance tailored to your unique goals and risk tolerance.

Psychological and Emotional Aspects of Financial Regrets

Turning Regrets into Lessons

- Here’s how you can use financial regrets as stepping stones to success:

- Identify the Regret: Be honest with yourself. What financial decision continues to nag at you? Write it down and explore the specific reasons behind it.

- Learn from the Experience: What knowledge or information did you lack at the time? Research the topic and educate yourself for future situations.

- Develop a Plan: Based on your learnings, create a concrete plan to avoid similar mistakes. This might involve budgeting more effectively, researching investments before diving in, or seeking professional financial guidance.

- Forgive Yourself: Everyone makes mistakes. Holding onto guilt won’t help. Forgive yourself, accept the past, and focus on positive change.

- Remember: The power lies not in erasing the past, but in using it as a springboard to a more secure financial future.

Conclusion

- Embrace the Journey

- Financial well-being is a journey, not a destination. There will be bumps along the road, but by learning from past experiences and making informed decisions, you can navigate your way towards a brighter financial future. Remember, you are not alone. Millions of people are working towards their financial goals, and you have the power to achieve yours too!