Introduction

Let’s face it, we’ve all been there. You see a friend’s vacation pictures on social media and think, “If only I’d saved more…” Or maybe a co-worker mentions their impressive investment returns, and you’re hit with a wave of “what ifs.” Financial regrets are a common experience, but dwelling on them won’t change the past. The good news? You can transform those regrets into powerful lessons that propel you towards a brighter financial future.

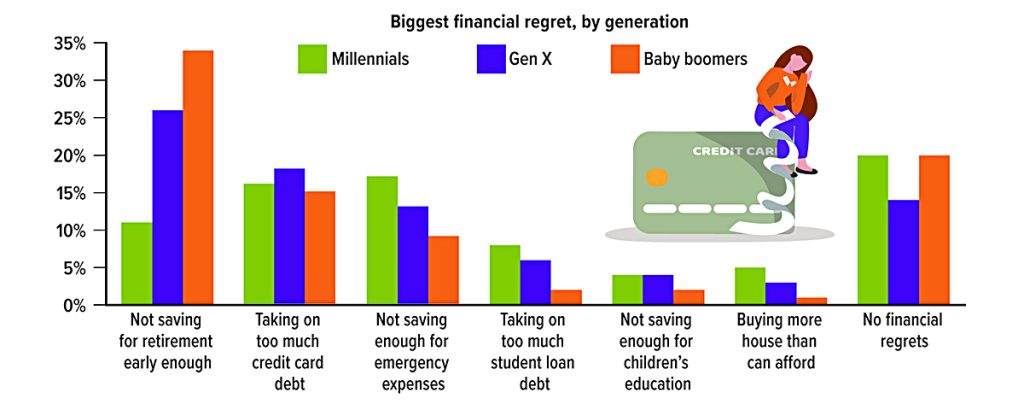

- A 2023 survey found that about three out of four U.S. adults had a financial regret. The most common were not saving for retirement early enough, taking on too much credit card debt, and not saving enough for emergency expenses. It’s probably not surprising that the weight that people placed on these and other regrets varied by generation — and regret about not saving early enough for retirement was higher for those closer to retirement age.

Common Financial Regrets

Financial regrets are common, with many individuals reflecting on past decisions that negatively impacted their financial health. Here are some of the most frequent financial regrets:

- Not Saving Enough: A major regret among Americans is not saving adequately for emergencies, retirement, or other financial goals. This lack of savings can lead to financial insecurity and missed opportunities .

- Excessive Spending and Debt: Many regret overspending and accruing substantial debt, which can create long-term financial strain and limit future opportunities .

- Missed Investment Opportunities: Failing to invest or not investing early enough is a common regret. Missing out on the potential growth that investments offer can significantly impact long-term financial health .

- Not Planning for Retirement: Many people regret not having a solid retirement plan, which can lead to financial challenges in their later years [6].

- Housing Decisions: Upgrading homes too quickly or not buying a home when prices and interest rates were favorable are common regrets. These decisions can impact long-term financial stability

Taking Control of Your Finances

Here are some resources to equip you on your financial journey:

- Free Budgeting Apps: There are numerous budgeting apps available to help you track income and expenses, and create a personalized spending plan.

- Financial Literacy Websites: Government websites and reputable non-profit organizations offer a wealth of information on personal finance basics, investing strategies, and debt management.

- Financial Advisors: Consider consulting a professional financial advisor for personalized guidance tailored to your unique goals and risk tolerance.

Psychological and Emotional Aspects of Financial Regrets

Turning Regrets into Lessons

- Here’s how you can use financial regrets as stepping stones to success:

- Identify the Regret: Be honest with yourself. What financial decision continues to nag at you? Write it down and explore the specific reasons behind it.

- Learn from the Experience: What knowledge or information did you lack at the time? Research the topic and educate yourself for future situations.

- Develop a Plan: Based on your learnings, create a concrete plan to avoid similar mistakes. This might involve budgeting more effectively, researching investments before diving in, or seeking professional financial guidance.

- Forgive Yourself: Everyone makes mistakes. Holding onto guilt won’t help. Forgive yourself, accept the past, and focus on positive change.

- Remember: The power lies not in erasing the past, but in using it as a springboard to a more secure financial future.

Conclusion

- Embrace the Journey

- Financial well-being is a journey, not a destination. There will be bumps along the road, but by learning from past experiences and making informed decisions, you can navigate your way towards a brighter financial future. Remember, you are not alone. Millions of people are working towards their financial goals, and you have the power to achieve yours too!

Unlocking International Investment Opportunities: A Comprehensive Guide

In the ever-evolving landscape of global markets, discerning investors continually seek avenues for growth and diversification beyond their domestic borders. As we navigate through the complexities of international investment, it becomes imperative to scrutinize recent market trends, economic dynamics, and governmental policies shaping investment landscapes worldwide. In this expansive guide, we delve into the contrasting narratives of two Asian economic powerhouses – Japan and China – while unraveling the broader implications for global investors.

Understanding Market Performances

The performance of global indices serves as a barometer for international investment sentiment. In 2023, the MSCI EAFE Index, encompassing developed markets outside the United States, saw a commendable 15% growth. In juxtaposition, the S&P 500 Index, reflecting U.S. equities, outpaced with a remarkable 24% return. However, within the Asian domain, Japan emerged as a frontrunner with its Nikkei 225 index surging by 28%, highlighting a robust economic revival. Conversely, China, despite its stature as the world’s second-largest economy, grappled with a downturn, evidenced by a staggering 11% decline in the CSI 300 Index, indicative of mounting economic challenges.

A Tale of Two Economies: Japan vs. China

At the heart of the divergent performances lie contrasting economic trajectories. Japan, once plagued by prolonged deflationary pressures, witnessed a resurgence buoyed by newfound inflation, robust corporate profitability, and strategic monetary policies. The recent culmination of Japan’s Nikkei index surpassing its 1989 peak signifies a remarkable turnaround, underpinned by proactive measures by the Bank of Japan.

Conversely, China, while maintaining a formidable GDP growth rate of 5.2% in 2023, grappled with multifaceted challenges. A real estate crisis, deflationary pressures, and a visible government crackdown on the private sector tarnished investor confidence, precipitating a downturn in stock indices. Despite efforts to stabilize the market, concerns linger regarding the sustainability of China’s economic trajectory amidst geopolitical uncertainties and structural reforms.

Navigating the Global Economic Landscape

Amidst these regional nuances, the global economic outlook remains nuanced yet cautiously optimistic. The International Monetary Fund (IMF) projects a steady growth trajectory of 3.1% for 2024, akin to the preceding year. However, looming fiscal challenges, high debt burdens, and the specter of inflationary pressures pose potential headwinds. Furthermore, the evolving dynamics within China’s property sector loom large, warranting vigilant monitoring by global investors.

Seizing Opportunities Amidst Complexity

While international markets offer an array of growth prospects, navigating these terrains demands nuanced strategies and risk management frameworks. Mutual funds and exchange-traded funds (ETFs) emerge as accessible vehicles for international exposure, ranging from broad global funds to region-specific or single-country allocations. However, discerning investors must tread cautiously, acknowledging the inherent risks associated with emerging markets and currency fluctuations.

Amidst the allure of burgeoning foreign markets, the adage of ‘chasing performance’ warrants prudence, emphasizing the importance of a disciplined, long-term investment approach. Diversification, a cornerstone of risk management, underscores the imperative of a well-calibrated portfolio spanning diverse geographies and asset classes.

Conclusion: Charting a Path Forward

As global markets continue to evolve, astute investors must embrace a holistic perspective, transcending geographical boundaries to seize opportunities amidst complexity. In navigating the dynamic interplay of economic forces and policy imperatives, informed decision-making remains paramount. Armed with a nuanced understanding of market dynamics and risk management principles, investors can embark on a journey towards unlocking the vast potential of international markets while safeguarding against inherent uncertainties.

Disclaimer:

This content is for informational purposes only and should not be construed as investment advice. Investing in international markets carries inherent risks, and individuals should conduct thorough research and seek professional guidance before making investment decisions. Past performance is not indicative of future results.

Navigating Regulatory Landscapes and Economic Realities

Beyond market dynamics, understanding the regulatory environments and economic realities of target jurisdictions is crucial for international investors. In Japan, recent policy shifts, such as the cessation of negative interest rates, underscore the evolving monetary landscape. Conversely, China’s regulatory crackdown on the private sector has prompted apprehension among foreign investors, necessitating a nuanced approach to risk assessment.

Mitigating Risks Through Diversification

Diversification remains a cornerstone of prudent investment strategies, offering insulation against market volatility and idiosyncratic risks. While international markets present unique opportunities, they also harbor distinctive challenges. Allocating across diverse geographies, sectors, and asset classes enables investors to mitigate concentration risks and enhance portfolio resilience.

Harnessing the Power of Exchange-Traded Funds (ETFs)

Exchange-traded funds (ETFs) have emerged as a popular vehicle for accessing international markets, offering liquidity, transparency, and diversification benefits. From broad-based global ETFs to niche offerings targeting specific regions or sectors, ETFs provide investors with a spectrum of options tailored to their risk preferences and investment objectives.

Developing a Holistic Investment Strategy

Crafting a robust investment strategy necessitates a holistic approach encompassing asset allocation, risk management, and portfolio rebalancing. Integrating international equities into a well-diversified portfolio can enhance risk-adjusted returns while mitigating exposure to domestic market fluctuations.

Conclusion: Navigating the Global Investment Landscape

In conclusion, the allure of international markets beckons investors seeking growth, diversification, and opportunities beyond domestic borders. However, navigating the intricacies of global investment landscapes demands astute judgment, diligent research, and a disciplined approach to risk management.

As we traverse the evolving terrain of international finance, staying abreast of market developments, regulatory shifts, and economic fundamentals is imperative. By embracing diversification, harnessing the potential of exchange-traded funds, and adhering to sound investment principles, investors can navigate the complexities of global markets with confidence and resilience.

The Markets (as of market close March 22, 2024)

Despite a dip last Friday, stocks closed out last week higher. The S&P 500 recorded its biggest weekly percentage gain of the year, while the Dow and the Nasdaq hit record highs. Investors gained a bit of encouragement after the Federal Reserve maintained projections for three interest rate cuts by year’s end. Each of the market sectors moved higher last week, with communication services and industrials gaining 3.9% and 3.5%, respectively. Both the dollar and gold prices advanced. Crude oil prices declined for the week, influenced by a rising dollar (since oil is priced in dollars, if the dollar goes up, oil prices generally go down, because you need fewer dollars to buy that oil).

Wall Street got off to a good start last week, led by tech and AI stocks. The Nasdaq rose 0.8%, followed by the S&P 500 (0.6%), the Global Dow (0.3%), and the Dow (0.2%). The small caps of the Russell 2000 fell 0.7%. Yields on 10-year Treasuries rose 3.6 basis points to 4.34%. Crude oil prices jumped $1.87 to settle at about $82.91 per barrel, the highest level since October. Reduced crude exports from Iraq and Saudi Arabia, along with rising demand, helped drive crude oil prices higher. The dollar and gold prices inched up 0.2% and 0.1%, respectively.

Stocks advanced for a second straight session last Tuesday as investors awaited the results of the Federal Reserve meeting. While it is widely anticipated that the Fed will maintain interest rates at their current level, attention will be focused on the projected frequency and timing of potential rate cuts. The Dow (0.8%) led the benchmark indexes, followed by the S&P 500 (0.6%), the Russell 2000 (0.5%), the Nasdaq (0.4%), and the Global Dow (0.3%). Ten-year Treasury yields settled at 4.29% after falling 4.3 basis points. Crude oil prices continued to surge, rising $0.75 to $83.47 per barrel. The dollar rose 0.2%, while gold prices dipped 0.2%.

Wall Street rallied last Wednesday as investors were cautiously encouraged by the Federal Reserve’s projections of three interest rate cuts this year. The Russell 2000 advanced 1.9%, the Nasdaq rose 1.3%, the Dow climbed 1.0%, the S&P 500 gained 0.9%, and the Global Dow increased 0.7%. Ten-year Treasury yields dipped 2.4 basis points, settling at 4.27%. Crude oil prices saw the end to a rally as prices fell $1.63 to $81.84 per barrel. The dollar fell 0.4%, while gold prices rose 1.4%.

Stocks continued to climb higher last Thursday, with each of the benchmark indexes listed here advancing. The Russell 2000 led the charge for the second straight session after increasing 1.1%, followed by the Global Dow (0.8%), the Dow (0.7%), the S&P 500 (0.3%), and the Nasdaq (0.2%). Ten-year Treasury yields moved minimally, closing at 4.27%. Crude oil prices dipped for the second consecutive day, settling at $80.90 per barrel. The dollar rose 0.6%, while gold prices rose 1.1%.

Equities closed generally lower last Friday, with only the Nasdaq finishing the session up after gaining 0.2% to reach a record high. The Russell 2000 lost 1.3%, followed by the Dow (-0.8%), the Global Dow (-0.3%), and the S&P 500 (-0.1%). Crude oil prices fell for the third straight session, dipping 0.31%. Ten-year Treasury yields fell 5.3 basis points to 4.21%. The dollar advanced 0.4%, while gold prices were flat.

Stock Market Indexes

| Market/Index | 2023 Close | Prior Week | As of 3/22 | Weekly Change | YTD Change |

|---|---|---|---|---|---|

| DJIA | 37,689.54 | 38,714.77 | 39,475.90 | 1.97% | 4.74% |

| Nasdaq | 15,011.35 | 15,973.17 | 16,428.82 | 2.85% | 9.44% |

| S&P 500 | 4,769.83 | 5,117.09 | 5,234.18 | 2.29% | 9.74% |

| Russell 2000 | 2,027.07 | 2,039.32 | 2,072.00 | 1.60% | 2.22% |

| Global Dow | 4,355.28 | 4,572.84 | 4,645.33 | 1.59% | 6.66% |

| fed. funds target rate | 5.25%-5.50% | 5.25%-5.50% | 5.25%-5.50% | 0 bps | 0 bps |

| 10-year Treasuries | 3.86% | 4.30% | 4.21% | -9 bps | 35 bps |

| US Dollar-DXY | 101.39 | 103.43 | 104.42 | 0.96% | 2.99% |

| Crude Oil-CL=F | $71.30 | $81.00 | $80.88 | -0.15% | 13.44% |

| Gold-GC=F | $2,072.50 | $2,161.20 | $2,168.10 | 0.32% | 4.61% |

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- The Federal Open Market Committee maintained the target range for the federal funds rate at 5.25%-5.50%, as expected. In its statement, the FOMC indicated that, “The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2.0%.” During his press conference following the meeting, Fed Chair Jerome Powell noted that an interest rate cut is not on the immediate horizon. As to the increase in prices over the past few months, Powell said that the Committee anticipated that the path of lowering inflation may be bumpy. However, the FOMC is looking at the performance of inflation over time, not just a few months. The Fed retained its forecast for three rate cuts this year.

- February saw sales of existing homes jump 9.5%, although sales declined 3.3% year over year. Additional supply and consistent demand have helped drive sales throughout the country. Unsold inventory sat at a 2.9-month supply in February, down from 3.0 months in January. The median existing-home sales price was $384,500 in February, up from $378,600 in January, and well above the February 2023 price of $363,600. Existing single-family home sales also grew in February, up 10.3% but down 2.7% from a year earlier. The median price for existing single-family homes was $388,700, higher than the January price of $382,900, and over the February 2023 price of $368,100.

- The number of residential building permits issued in February was 1.9% above the January rate. The number of single-family building permits issued in February increased 1.0%. The number of housing starts in February rose 10.7% above the January estimate, while single-family housing starts increased 11.6%. Housing completions in February rose 19.7% over January. Single-family housing completions advanced 20.2% last month. Your FREE personalized Moon Reading explores the secret depths of your personality, relationships and true purpose in life

- The national average retail price for regular gasoline was $3.453 per gallon on March 18, $0.077 per gallon more than the prior week’s price and $0.031 per gallon more than a year ago. Also, as of March 18, the East Coast price increased $0.084 to $3.349 per gallon; the Midwest price rose $0.022 to $3.309 per gallon; the Gulf Coast price increased $0.154 to $3.099 per gallon; the Rocky Mountain price rose $0.089 to $3.166 per gallon; and the West Coast price increased $0.084 to $4.380 per gallon.

- For the week ended March 16, there were 210,000 new claims for unemployment insurance, a decrease of 2,000 from the previous week’s level, which was revised up by 3,000. According to the Department of Labor, the advance rate for insured unemployment claims for the week ended March 9 was 1.2%, unchanged from the previous week’s rate. The advance number of those receiving unemployment insurance benefits during the week ended March 9 was 1,807,000, an increase of 4,000 from the previous week’s level, which was revised down by 8,000. States and territories with the highest insured unemployment rates for the week ended March 2 were New Jersey (2.9%), Rhode Island (2.7%), California (2.5%), Minnesota (2.5%), Massachusetts (2.4%), Illinois (2.2%), Montana (2.0%), New York (2.0%), Pennsylvania (2.0%), Alaska (1.9%), Connecticut (1.9%), and Washington (1.9%). The largest increases in initial claims for unemployment insurance for the week ended March 9 were in Oregon (+2,216), California (+462), Indiana (+427), Texas (+392), and Nevada (+342), while the largest decreases were in New York (-14,583), Ohio (-1,453), New Hampshire (-446), Massachusetts (-305), and Vermont (-289).

Eye on the Week Ahead

The last week of March brings with it the final estimate of gross domestic product for the fourth quarter of 2023. According to the second estimate, the economy accelerated at an annualized rate of 3.2%. Also out this week is the February report on personal income and expenditures, which includes the personal consumption expenditures price index, the preferred inflation indicator of the Federal Reserve. With other indicators, such as the Consumer Price Index, showing that inflation rose in February, it is expected the PCE price index will also show in increase consumer prices.

Data sources: Economic: Based on data from U.S. Bureau of Labor Statistics (unemployment, inflation); U.S. Department of Commerce (GDP, corporate profits, retail sales, housing); S&P/Case-Shiller 20-City Composite Index (home prices); Institute for Supply Management (manufacturing/services). Performance: Based on data reported in WSJ Market Data Center (indexes); U.S. Treasury (Treasury yields); U.S. Energy Information Administration/Bloomberg.com Market Data (oil spot price, WTI, Cushing, OK); www.goldprice.org (spot gold/silver); Oanda/FX Street (currency exchange rates).

News items are based on reports from multiple commonly available international news sources (i.e., wire services) and are independently verified when necessary with secondary sources such as government agencies, corporate press releases, or trade organizations. All information is based on sources deemed reliable, but no warranty or guarantee is made as to its accuracy or completeness. Neither the information nor any opinion expressed herein constitutes a solicitation for the purchase or sale of any securities, and should not be relied on as financial advice. Forecasts are based on current conditions, subject to change, and may not come to pass. U.S. Treasury securities are guaranteed by the federal government as to the timely payment of principal and interest. The principal value of Treasury securities and other bonds fluctuates with market conditions. Bonds are subject to inflation, interest-rate, and credit risks. As interest rates rise, bond prices typically fall. A bond sold or redeemed prior to maturity may be subject to loss. Past performance is no guarantee of future results. All investing involves risk, including the potential loss of principal, and there can be no guarantee that any investing strategy will be successful.

The Dow Jones Industrial Average (DJIA) is a price-weighted index composed of 30 widely traded blue-chip U.S. common stocks. The S&P 500 is a market-cap weighted index composed of the common stocks of 500 largest, publicly traded companies in leading industries of the U.S. economy. The NASDAQ Composite Index is a market-value weighted index of all common stocks listed on the NASDAQ stock exchange. The Russell 2000 is a market-cap weighted index composed of 2,000 U.S. small-cap common stocks. The Global Dow is an equally weighted index of 150 widely traded blue-chip common stocks worldwide. The U.S. Dollar Index is a geometrically weighted index of the value of the U.S. dollar relative to six foreign currencies. Market indexes listed are unmanaged and are not available for direct investment.

Introduction

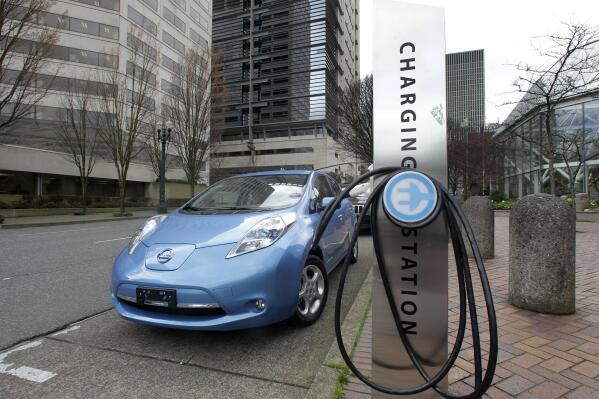

Three federal income tax credits may be available to help offset your cost to purchase certain clean vehicles (including electric, plug-in hybrid, and fuel cell vehicles).

The new clean vehicle tax credit can be either a personal or a general business tax credit, depending on whether the vehicle is used in a trade or business. The previously-owned clean vehicles tax credit is a personal tax credit. The qualified commercial clean vehicles tax credit is a general business tax credit. These credits are nonrefundable if they exceed your tax liability. An unused general business tax credit can be carried forward to a later year.

New clean vehicle tax credit

A personal or general business tax credit of up to $7,500 is available for the purchase of new clean vehicles meeting certain requirements (including electric, plug-in hybrid, and fuel cell vehicles). A credit of $3,750 is available if a critical minerals requirement is met, and a credit of $3,750 is available if a battery components requirement is met. Fuel cell vehicles that have final assembly within North America can qualify for the credit without regard to these two requirements.

A vehicle placed in service after 2023 with battery components manufactured or assembled by a foreign entity of concern is not eligible for any amount of the credit. Also, a vehicle placed in service after 2024 with applicable critical minerals in the battery that are extracted, processed, or recycled by a foreign entity of concern is not eligible for any amount of the credit.

Vehicle eligibility

In addition to the critical minerals, battery components, and other vehicle requirements, the vehicle cannot be acquired for resale.

The credit is not available for vehicles with a manufacturer’s suggested retail price (MSRP) higher than $80,000 for vans, sport utility vehicles, and pickups, or $55,000 for other vehicles (generally, passenger automobiles). For this purpose, the MSRP is the base retail price suggested by the manufacturer, plus the retail price suggested by the manufacturer for each accessory or item of optional equipment physically attached to the vehicle at the time of delivery to the dealer. It does not include destination charges, optional items added by the dealer, or taxes and fees.

You can check the eligibility of vehicles for the credit at fueleconomy.gov. Final confirmation of vehicle qualification should be done at the time of purchase. The seller must provide you with a report about a vehicle’s eligibility at the time of sale.

Purchaser’s income limitation

The credit is generally not available if the modified adjusted gross income (MAGI) of the purchaser for the taxable year or the preceding taxable year (whichever is less) exceeds $150,000 ($300,000 for joint filers and surviving spouses, $225,000 for heads of households). The income limitation does not apply to corporations subject to the corporate income tax. In the case of a partnership or S corporation, the credit is allocated to the partners or shareholders, respectively, and the income limitation is applied to those individuals.

Personal or general business tax credit

The new clean vehicle tax credit can be either a personal or a general business tax credit, depending on whether the vehicle is used in a trade or business. If the vehicle is used 50% or more for business, the credit is treated as a general business tax credit; otherwise, the credit is allocated between personal and business use. The credit is nonrefundable if it exceeds your tax liability. An unused general business tax credit can be carried forward to a later year.

Transfer of credit to dealer

In 2024 and later years, you may be able to irrevocably elect to transfer the credit attributable to personal use of the vehicle to dealers as payment for the vehicle.

Previously-owned clean vehicles tax credit

A personal tax credit equal to the lesser of $4,000 or 30% of the sales price is available to individuals for the purchase of certain previously-owned clean vehicles from a dealer. The credit is available only for the first transfer of the vehicle after August 16, 2022, to a person other than the person with whom the original use of the vehicle commenced (purchaser will need to check the sales history of the vehicle).

The credit is not available for vehicles with a sales price exceeding $25,000. Nor is the credit available if the purchaser’s MAGI for the taxable year or the preceding taxable year (whichever is less) exceeds $75,000 ($150,000 for joint filers and surviving spouses, $112,500 for heads of households).

The vehicle must meet a number of requirements. General eligibility of vehicles for the credit can be checked at fueleconomy.gov.

There are a number of other requirements that you and the previously-owned clean vehicle must meet:

- The model year must be at least two years earlier than the year in which you acquire the vehicle

- The original use of the vehicle commenced with some other person

- You cannot claim the credit if you can be claimed as a dependent by someone else

- You cannot claim the credit more than once during a three-year period

- You must purchase the vehicle for use and not for resale

In 2024 and later years, you may be able to irrevocably elect to transfer the credit to dealers who choose to participate in the program. The dealer can then receive advance payments of the credit from the IRS shortly after the sale. In return for your transferring the credit, the dealer provides a financial benefit equal to the credit to you in cash or in the form of a partial payment or down payment for the purchase of the vehicle.

Qualified commercial clean vehicles tax credit

A general business tax credit of up to $7,500 ($40,000 if the vehicle weighs 14,000 or more pounds) is available for the purchase of a qualified commercial clean vehicle meeting certain requirements.

The credit is equal to the lesser of (a) 15% of the tax basis (generally, the purchase price reduced by any section 179 expense deduction) of the vehicle (30% if the vehicle is not powered by a gasoline or diesel internal combustion engine), or (b) the incremental cost of the vehicle. The incremental cost is the excess of the purchase price of the clean vehicle over the price of a comparable vehicle that is powered solely by a gasoline or diesel internal combustion engine.

The vehicle:

- Must be acquired for use or lease by the taxpayer and not for resale

- Must be manufactured by a qualified manufacturer

- Must be manufactured primarily for use on public roads and highways, or is certain mobile machinery

- Must be propelled to a significant extent by an electric motor with a capacity of not less then 15 kilowatt hours (seven kilowatt hours for vehicles weighing less than 14,000 pounds) and is capable of being recharged from an external source of electricity, or be a qualified fuel cell vehicle (i.e., propelled by power derived from one or more cells that convert chemical energy directly into electricity by combining oxygen with hydrogen fuel)

A qualified commercial clean vehicle tax credit is not allowed with respect to a vehicle for which a new clean vehicle tax credit was allowed.

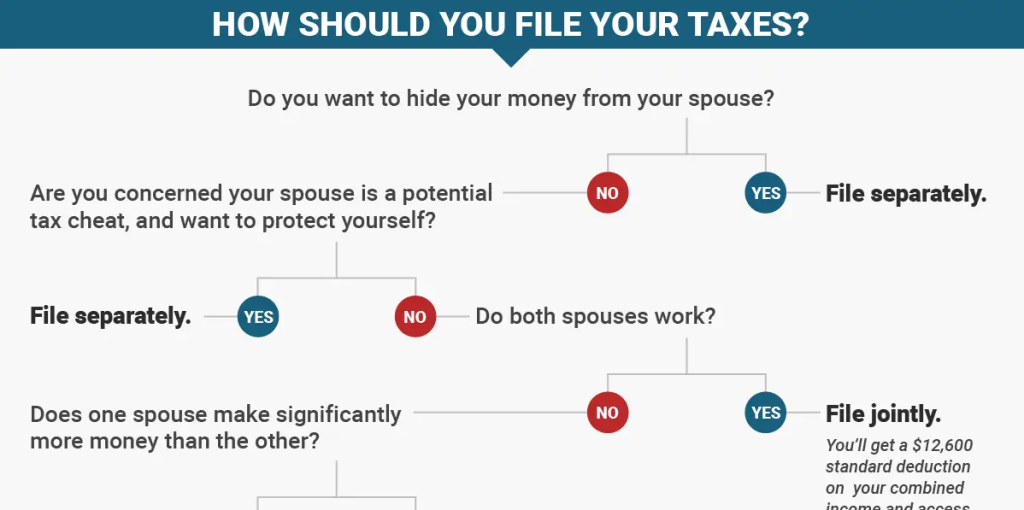

What is it?

Married filing separately is an option available to all married individuals when choosing a filing status for their federal income tax returns. Your filing status is important because it determines, in part, the amount of your standard deduction, the deductions and credits that are available to you, and the amount of your correct tax for the year. When filing a joint return, you and your spouse combine all income, exemptions (personal exemptions are suspended for 2018 to 2025), deductions, and credits. When filing separate returns, you report and pay tax only on your own income and take credit only for your own deductions and credits.

Who can file a married filing separately return?

You must be considered married for the tax year

In order to file a married and separate return for a given tax year, you must be considered married for that tax year. You are considered married for the tax year if you are married on the last day of the year.

You have not already filed a joint tax return for the year

Once you file a joint return, you cannot file an amended tax return to change your filing status to married filing separately after the due date of the tax return (usually April 15). If the due date has passed, it’s too late to change your mind.

Reporting income, deductions, exemptions, and credits on separate returns

General rule

When you file married and separate, you must include all income that you individually earn or receive. This includes wages and self-employment income. If you are deemed to own property under the laws of your state, you report any income that the property generates on your separate return. If you own property jointly with your spouse, you report a portion of the income generated by the property (based on your share of ownership). So, if you own the property equally, you will each report one-half the income generated by the property.

Similarly, you report only exemptions (personal exemptions are suspended for 2018 to 2025), deductions, and credits to which you are individually entitled. You may be able to claim deductions on your separate return for expenses that you paid jointly, but special rules apply, and you should refer to IRS Publications 501 and 504.

Special rules for community property states

If you live in a community property state (Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington, and Wisconsin), you will need to familiarize yourself with local law. (You may also be able to elect community property treatment under Alaska law.) The general rule in community property states is that you and your spouse split community income equally when you file separate returns. Community income includes wages earned by either you or your spouse during the marriage, as well as income from any community property. (Generally, this is property that you or your spouse acquired during marriage while living in a community property state.)

You and your spouse live in a community property state that considers wages earned during a marriage to be community income and requires such income to be split evenly. Your spouse earns $100,000 a year in wages, while you are not employed. If you and your spouse file your federal tax return as married filing separately, each of you will report $50,000 in wages.

If you and your spouse have not lived together at all during the tax year, special rules apply, and you should consult a tax professional.

Any deductions paid from community funds must be divided evenly if you and your spouse file separately.

Advantages

You don’t need your spouse’s consent

Unlike filing jointly, you don’t need your spouse’s consent to file a separate federal income tax return. Further, you don’t have to wait for your spouse to file his or her own return.

Separate liability

If you file separately, you are responsible only for the taxes on your own return.

If you are contemplating separation or divorce, the importance of this factor should not be underestimated. Imagine receiving a notice from the IRS two years after your divorce is final, explaining that you owe money because your spouse didn’t report some earnings on a joint tax return that you filed.

In certain situations, filing separate returns can result in less total tax

Generally, filing separately results in a higher combined tax liability for you and your spouse than if you file jointly (see discussion in the section on disadvantages, below). However, in some circumstances, filing separate returns can actually result in a lower combined tax liability.

This occurs because some deductions are allowed only when they rise above a certain amount (determined as a percentage of adjusted gross income). Medical expenses, casualty losses, and miscellaneous itemized deductions (miscellaneous itemized deductions subject to a 2 percent floor are suspended for 2018 to 2025) are deductible only to the extent that they exceed a specific percentage of income. Filing separate returns reduces the income on each spouse’s return. Because the income on each return is less than it would be on a joint return, the amount that these deductions have to exceed to be deductible is reduced as well.

Ken and Sue are married, and each earns $100,000 in 2024. They pay $10,000 in state tax during the year, have deductible home mortgage interest of $11,000, and make $4,000 in charitable contributions. Sue has $20,000 in medical expenses.

(1) If Ken and Sue file jointly:

| Their combined adjusted gross income is $200,000 | $200,000 |

|---|---|

| Medical expenses are deductible only to the extent that they exceed 7.5% of adjusted gross income (7.5% of $200,000 = $15,000), so the amount of medical expenses that can be deducted is $5,000 ($20,000 – $15,000). | $5,000 |

| All other itemized deductions total $25,000. | $25,000 |

| When these itemized deductions are subtracted from adjusted gross income, Ken and Sue are left with $170,000 in taxable income for tax year 2024. | $170,000 |

| Tax | $27,506 |

(2) If Ken and Sue file separately:

Ken:

| Adjusted gross income is $100,000 | $100,000 |

|---|---|

| Itemized deductions (half of state taxes paid, half of home mortgage interest, half of charitable contribution) total $12,500. | $12,500 |

| Taxable income of $87,500 | $87,500 |

| Tax | $14,303 |

Sue:

| Adjusted gross income is $100,000 | $100,000 |

|---|---|

| Itemized deductions – Medical expenses ($20,000) are deductible to the extent that they exceed 7.5% of adjusted gross income (7.5% of $100,000 adjusted gross income is $70,500), so deductible medical expenses are $12,500 ($20,000 less $70,500). When Sue adds half of state taxes, half of the home mortgage interest, and half of the charitable contribution, her itemized deductions total $25,000. | $25,000 |

| Taxable income of $75,000 | $75,000 |

| Tax | $11,553 |

Filing separately, the couple’s total tax ($25,856) is less than if they had filed jointly ($27,506).

The only way to know for sure which filing status will give you the lowest total tax is to do the calculations both ways (jointly and separately) and compare the results.

If you know that you’re going to file separate returns, consider doing a little planning. You can decide ahead of time who is going to pay what deductible expenses.

You can change your mind

If you or your spouse (or both) file separate returns, you can change to a joint return any time within three years from the due date (not including extensions) of the separate returns.

To change your filing status to married filing jointly, you and your spouse must complete and file Form 1040X, Amended U.S. Individual Income Tax Return.

Disadvantages

Filing separately is more complicated

Unlike filing a joint return, in which you simply combine all income and deductions, filing separate returns entails allocating income and deductions between you and your spouse. If you live in a community property state, you’ll have to split income and deductions.

Generally, filing separate tax returns results in more total tax than filing jointly

Most married couples pay more total tax when they file separately than when they file jointly. This is because the tax rate is effectively higher if you file separately. In addition, any of the factors discussed below could result in greater total tax.

The only way to know for sure which filing status will give you the lowest total tax is to do the calculations both ways (jointly and separately) and compare the results.

Availability of tax credits and deductions is reduced

If you file separately, you cannot take the earned income credit (a refundable credit available to individuals who qualify based on income and family situation). Your ability to take advantage of the credit for child and dependent care expenses and the credit for the elderly and disabled is also significantly limited. Further, you can only take deductions for expenses that you actually paid, and filing separate returns affects your ability to claim dependent exemptions in some situations (personal and dependency exemptions are suspended for 2018 to 2025),.

If your spouse itemizes deductions, you have to itemize as well

If you file separately and your spouse itemizes deductions, you must also itemize, even if your total itemized deductions are less than the standard deduction you would otherwise be entitled to.

You file a separate tax return, and your spouse itemizes deductions. The standard deduction for an individual who files separately is $14,600 in 2024. You have total itemized deductions of $1,000. Since your itemized deductions do not total more than $14,600, you would normally take the standard deduction. However, your spouse itemizes deductions, so you don’t have a choice. You have to itemize, taking a deduction of $1,000.

Larger portion of Social Security benefits may be included in income

If you file separately and lived with your spouse during any part of the year, a larger maximum percentage of your Social Security benefits (85 percent) may have to be included in your income.

Negative impact on ability to take advantage of IRAs

If you file separate returns, your ability to make deductible contributions to a traditional IRA is reduced. Furthermore, your ability to contribute to a Roth IRA is limited.

You can’t make spousal IRA contributions

Spousal IRA contributions are contributions made to an IRA for a nonworking spouse or a spouse with little income. You can’t make such contributions if you are filing separate returns.

Reduced ability to exclude income

When you file separately, the benefit of the $25,000 passive loss allowance for actively managed rental real estate may be reduced or eliminated. Additionally, no exclusion is allowed for interest on EE savings bonds (may also be called Patriot bonds) used for higher education expenses.

Married couples may pay more total tax than they would if unmarried filing as single individuals (“marriage penalty”)

The total tax of two unmarried individuals (each filing as single) may be less than the total tax if the two individuals are married, whether they file jointly or separately. This is particularly true when the two individuals have relatively equal incomes. This is often referred to as the “marriage penalty.”

The marriage penalty can occur, for example, when the tax code provides tax brackets that are wider but not twice as wide as those for single filers.

Not all married couples experience a marriage penalty. In fact, where one spouse earns significantly more than another spouse, filing a joint return will often result in tax savings.

]]>

What is it?

A Section 2503(b) trust is an irrevocable trust often established for the benefit of a minor child, although it can be established for anyone. It is named after Section 2503(b) of the Internal Revenue Code, which permits an exception to the general rule that only gifts of present interests (i.e., the right to immediately use, possess, or enjoy the property) qualify for the $18,000 (in 2024) annual gift tax exclusion. Although transfers to a Section 2503(b) trust are future interest gifts, they are treated as present interest gifts that qualify for the exclusion. This exception is allowed because the trust must distribute to the beneficiary all the income earned at least once a year.

Unlike a Section 2503(c) trust, which requires that all principal be distributed or made available to the minor beneficiary when he or she reaches age 21, there is no set time at which the principal in a Section 2503(b) trust must be distributed. In fact, a Section 2503(b) trust can be drafted so that the principal is never actually paid out to the minor child beneficiary. The trust can be written so that someone of your choosing, other than the minor child beneficiary, will eventually receive the principal, or the trust can allow the minor beneficiary to make that choice.

For federal gift tax purposes, the minor child beneficiary’s income interest in a gift made to a Section 2503(b) trust is the actuarial value of the right to receive annual income from the gift for life (or a term of years). The value of the income interest depends on the beneficiary’s life expectancy (or the term of the trust), as well as the Section 7520 rate (an assumed rate of return set monthly by the IRS) in effect at the time of the gift. This income interest — calculated in advance — should not to be confused with the actual income produced by the trust assets each year.

Under Section 2503(b), all income from the trust must be distributed to the minor child beneficiary at least once a year. However, the income does not have to be directly transferred to the beneficiary. You (the grantor) can direct the income to a custodial account set up under the Uniform Transfers to Minors Act (UTMA) or the Uniform Gifts to Minors Act (UGMA). The money can then be held in the custodial account until the beneficiary is older or it is otherwise appropriate to make distributions.

The income that is distributed from a Section 2503(b) trust to the beneficiary will be taxed to the beneficiary. However, be aware of the kiddie tax rules. Unearned income above $2,600 (in 2024) may be taxed at the parents’ tax rates. The kiddie tax rules apply to: (1) those under age 18, (2) those age 18 whose earned income doesn’t exceed one-half of their support, and (3) those ages 19 to 23 who are full-time students and whose earned income doesn’t exceed one-half of their support.

If trust funds are used to satisfy a parent’s legal duty to support the child beneficiary, those funds will be taxed to the parent.

Some estate planners recommend a Crummey trust rather than a Section 2503(b) or Section 2503(c) trust. With a Crummey trust, under current law, as long as the beneficiaries are given the right (for a certain period of time — usually 30-60 days) to withdraw any transfers to the trust, the gift to the trust will be considered a present interest and therefore qualify for the annual exclusion. The main reason that planners have favored the Crummey trust alternative is that it does not have all the restrictions and limitations that Section 2503(b) and Section 2503(c) trusts have. Unfortunately, because of perceived abuses, Crummey trusts have long faced opposition and scrutiny by the IRS. You should be mindful of the uncertain future of this common estate planning tool. Need a mortgage!!! A few minutes, a few clicks, up to 5 competing mortgage quotes

When can it be used?

You want to transfer assets to a beneficiary but do not want the beneficiary to have control of the assets

You may want to set up a Section 2503(b) trust if you would like to make gifts for the benefit of a minor, but you do not want the child to have direct control of the assets. Although the beneficiary must receive all income from the trust at least annually, the trust document can specify that these payments be made to a custodial account rather than directly to the minor. Furthermore, you can arrange for the trust to invest in low-income high-growth assets to limit the income the trust earns, and hence lower the distributions to the beneficiary.

There must be a separate Section 2503(b) trust for each desired beneficiary.

You want to make gifts to a minor and achieve income tax savings

The income that is distributed from a Section 2503(b) trust to the beneficiary will be taxed to the beneficiary. However, be aware of the kiddie tax rules. Unearned income above $2,600 (in 2024) may be taxed at the parents’ tax rates. The kiddie tax rules apply to: (1) those under age 18, (2) those age 18 whose earned income doesn’t exceed one-half of their support, and (3) those ages 19 to 23 who are full-time students and whose earned income doesn’t exceed one-half of their support. Need a mortgage!!! A few minutes, a few clicks, up to 5 competing mortgage quotes

Strengths

Gifts are treated as present interest gifts that qualify (to some extent) for annual gift tax exclusion

Typically, a transfer of assets to a trust does not qualify for the federal annual gift tax exclusion because the beneficiaries of a trust typically do not have a present interest in the assets transferred to the trust. However, if a trust meets all the requirements of Section 2503(b), a transfer of assets to this trust will usually be treated as a present interest that qualifies for the annual exclusion.

In most cases, the entire value of the transfer to the trust will not qualify for the annual exclusion. Transfers to the trust must be divided into an income portion and a remainder portion. The income portion qualifies for the annual gift tax exclusion, while the remainder portion is considered a taxable gift. There is a complicated calculation to figure out what part of the transfer is income and what part is remainder (your estate planning attorney can make this determination for you). However, when the beneficiary of the trust is a minor, the income portion of the gift will always be a very high percentage of the gift. Need a mortgage!!! A few minutes, a few clicks, up to 5 competing mortgage quotes

Allows flexibility on distribution of principal

Unlike a Section 2503(c) trust, where the trust principal must be paid out or be made available to the beneficiary when he or she turns 21, there are no limitations on when the principal in a Section 2503(b) trust must be distributed. In fact, there is no requirement that the principal ever has to be paid out to the beneficiary. The beneficiary could simply receive income from the trust until his or her death, and then the principal could be paid to a third party.

May result in income tax savings

There may be substantial income tax savings if the beneficiary of the Section 2503(b) trust is not subject to the kiddie tax rules (see above).

May result in estate tax savings

A Section 2503(b) trust must be set up as an irrevocable trust. If the trust document is properly drafted so that you do not attach any impermissible “strings,” the assets in the trust, including any appreciation in their value, will not be includable in your gross estate for estate tax purposes at your death. Need a mortgage!!! A few minutes, a few clicks, up to 5 competing mortgage quotes

You set up a Section 2503(b) trust and name your only child the beneficiary. Over the course of 10 years, you transfer $100,000 to the trust, utilizing both the annual exclusion and a portion your gift and estate tax exemption to avoid paying any federal gift tax. The trust doesn’t allow you to use trust assets to satisfy your legal duty to support your child. At your death, the assets are worth $300,000. The entire $300,000 is not included in your gross estate. By using this type of trust, you have removed a substantial amount of assets from your gross estate for little, if any, gift tax cost.

Tradeoffs

Income must be paid out each year to beneficiary

One of the biggest tradeoffs to setting up a Section 2503(b) trust is that the income from the trust must be paid out each year to the beneficiary of the trust. With a Section 2503(c) trust or a Crummey trust, the income does not have to be paid out to the beneficiary. In many cases, especially if the beneficiary is a minor, you may not want income to be paid out (even though the income can be paid to a custodian) every year.

Trust is irrevocable

A Section 2503(b) trust must be set up as an irrevocable trust. Once the trust is formed, a beneficiary named, and assets transferred to the trust, you lose the ability to alter or end the trust. For example, you cannot change the trust’s beneficiary.

You will incur costs to establish and maintain the trust

You will incur the costs to hire an experienced estate planning attorney to draft the trust document and transfer assets to the trust. You may also want to hire a professional trustee (a bank trust department or a professional fiduciary), in which case you will have to pay trustee fees each year. You may also have to pay to have tax returns prepared for the beneficiary of the trust.

Because of the costs associated with establishing and maintaining a Section 2503(b) trust, it generally makes sense to do so only if you set up the account with a significant lump sum. Need a mortgage!!! A few minutes, a few clicks, up to 5 competing mortgage quotes

Entire transfer to trust will not qualify for annual gift tax exclusion

Another tradeoff to a Section 2503(b) trust is that the entire transfer will not qualify for the annual exclusion from the federal gift tax. When a gift is made to a Section 2503(b) trust, the gift must be divided into an income interest (a present interest) and a remainder interest (a future interest). (Your attorney or accountant can compute the division of the gift for you; there is a complicated formula that must be used.) The income interest part of the gift will qualify for the annual exclusion, but the remainder interest will not qualify. If the beneficiary is a minor, then usually 90 percent or more of the transfer will be considered an income interest (and thus be treated as a present interest that qualifies for the annual exclusion). The remaining percentage will be a remainder interest and not qualify for the annual exclusion. You must use your gift tax exemption or pay the applicable federal gift tax on this portion.Need a mortgage!!! A few minutes, a few clicks, up to 5 competing mortgage quotes

You set up a Section 2503(b) trust and name your 10-year-old son the sole beneficiary of the trust. You make an initial transfer of $10,000 to the trust. Your accountant tells you that $9,000 of the transfer will be treated as a present interest that qualifies for the annual exclusion. The remaining $1,000 is subject to the federal gift tax. You can then use a portion your gift and estate tax applicable exclusion amount (if available) to offset the applicable gift tax.

How to do it

Hire attorney to draft trust

You should hire an experienced and competent estate planning attorney to draft the Section 2503(b) trust document. There are some fairly complicated estate and income tax issues that must be considered when drafting and operating the trust. As noted, you will also need your attorney (or accountant) to calculate what percentage of any transfer qualifies for the annual exclusion and what percentage is subject to the federal gift tax.

Transfer assets to the trust

Because you will incur costs to establish a Section 2503(b) trust, it usually makes sense to establish such a trust only if you can transfer a cost efficient amount to the trust. If you would like to transfer a more modest amount, it might make more sense to make a gift under the Uniform Gifts to Minors Act (UGMA) or under the Uniform Transfers to Minors Act (UTMA). Once a Section 2503(b) trust is established, you can make as many contributions to the trust as you like. Need a mortgage!!! A few minutes, a few clicks, up to 5 competing mortgage quotes

Beneficiary must file income tax returns

Because income from a Section 2503(b) trust is distributed to the beneficiary, that person must file an income tax return (if the income is above the minimum threshold).

What is it?

A Section 2503(c) trust is an irrevocable trust established to hold gifts for a minor child until the child turns 21. It is named after Section 2503(c) of the Internal Revenue Code, which permits an exception to the general rule that only gifts of present interests (i.e., the right to immediately use, possess, or enjoy the property) qualify for the $18,000 (in 2024) annual gift tax exclusion. So although transfers to the trust are future interest gifts, they will be treated as present interest gifts that qualify for the exclusion. This exception is permitted because a Section 2503(c) trust requires the beneficiary to have the right to withdraw trust funds when he or she reaches the age of 21.

Unlike a Section 2503(b) trust, which requires the trust to distribute all income to the beneficiary at least once a year, a Section 2503(c) trust can retain all income while the minor beneficiary is under 21. In that event, the trust pays income taxes (at the special rates for trusts) on the trust’s earnings. Meanwhile, the trustee may use the income, as well as the principal, for the child’s benefit.

Alternatively, the trust can require or permit its income to be distributed directly to the child beneficiary, or to a custodial account for his or her benefit under the Uniform Transfers to Minors Act (UTMA) or Uniform Gifts to Minors Act (UGMA). In that event, the income is taxed to the child beneficiary. Need a mortgage!!! A few minutes, a few clicks, up to 5 competing mortgage quotes

If trust income is used to satisfy a parent’s legal duty to support a child, it will be taxed to the parent.

When the child reaches age 21, he or she typically receives the remaining principal and income. However, the trust document can grant the child the right to extend the trust term beyond age 21. This power can be a right for a limited time period (e.g., 60 days after the child’s 21st birthday) or a continuing right. If the right is not exercised, then the trust terminates in accordance with its terms. If the right is exercised, then the trust term is extended. However, transfers cease to qualify for the annual gift tax exclusion, unless the trust document allows the beneficiary at least a limited period during which he or she may withdraw the gifts. This limited power of withdrawal is known as a Crummey power.

In order to be a valid Section 2503(c) trust under IRS rules, the trust must meet all the following requirements:

- The trustee must have the power to use the trust assets (principal and income) for the child’s benefit until the child reaches age 21

- The property must be distributed or be made available to the child at age 21

- The property must be included in the child’s gross estate if the child dies before age 21

The main difference between a Section 2503(c) trust and a Section 2503(b) trust is the distribution requirement. With a Section 2503(c) trust, distributions to the beneficiary prior to age 21 are discretionary, but the beneficiary must be given access to the trust funds at age 21. With a Section 2503(b) trust, the beneficiary must receive income from the trust at least annually, but there is no requirement that the beneficiary be given access to the funds at age 21, or ever for that matter.

Some estate planners recommend a Crummey trust rather than a Section 2503(c) or Section 2503(b) trust. With a Crummey trust, under current law, as long as the beneficiaries are given the right (for a certain period of time — usually 30-60 days) to withdraw any transfers to the trust, the gift to the trust will be considered a present interest and therefore qualify for the annual exclusion. The main reason that planners have favored the Crummey trust alternative is that it does not have all the restrictions and limitations that Section 2503(c) and Section 2503(b) trusts have. Unfortunately, because of perceived abuses, Crummey trusts have long faced opposition and scrutiny by the IRS. You should be mindful of the uncertain future of this common estate planning tool. Need a mortgage!!! A few minutes, a few clicks, up to 5 competing mortgage quotes

When can it be used?

You want to transfer assets to a beneficiary but do not want the beneficiary to have control of the assets

You may want to set up a Section 2503(c) trust if you would like to make gifts for the benefit of a minor, but you do not want the child to have direct control of the assets. Although the beneficiary may receive income from the trust, the trust document can specify that these payments be made to a custodial account rather than directly to the minor.

There must be a separate Section 2503(c) trust for each desired beneficiary.

You want to make gifts to a minor and achieve income tax savings Need a mortgage!!! A few minutes, a few clicks, up to 5 competing mortgage quotes

The income that is distributed from a Section 2503(c) trust to the beneficiary will be taxed to the beneficiary. However, be aware of the kiddie tax rules. Unearned income above $2,600 (in 2024) may be taxed at the parents’ tax rates. The kiddie tax rules apply to: (1) those under age 18, (2) those age 18 whose earned income doesn’t exceed one-half of their support, and (3) those ages 19 to 23 who are full-time students and whose earned income doesn’t exceed one-half of their support.

Strengths

Gifts are treated as present interest gifts that qualify for annual gift tax exclusion

Typically, a transfer of assets to a trust does not qualify for the federal annual gift tax exclusion because the beneficiaries of a trust typically do not have a present interest in the assets transferred to a trust. However, if a trust meets all the requirements of Section 2503(c), a transfer of assets to the trust will usually be treated as present interests that qualify for the annual exclusion.

May result in income tax savings

There may be substantial income tax savings if the beneficiary of the Section 2503(c) trust is not subject to the kiddie tax rules (see above).

May result in federal gift and estate tax savings

A Section 2503(c) trust must be set up as an irrevocable trust. If the trust document is properly drafted so that you do not attach any impermissible “strings,” the assets in the trust, including any appreciation in their value, will not be includable in your gross estate for federal gift and estate tax purposes at your death. Need a mortgage!!! A few minutes, a few clicks, up to 5 competing mortgage quotes

You set up a Section 2503(c) trust and name your only child the beneficiary. Over the course of 10 years, you transfer $100,000 to the trust, utilizing both the annual exclusion and a portion your gift and estate tax applicable exclusion amount to avoid paying any federal gift and estate tax. The trust doesn’t allow you to use trust assets to satisfy your legal duty to support your child. At your death, the assets are worth $300,000. The entire $300,000 is not included in your gross estate. By using this type of trust, you have removed a substantial amount of assets from your gross estate for little, if any, gift and estate tax cost.

Let’s you earmark gifts to minor beneficiaries

With a Section 2503(c) trust, you can earmark gifts intended for college (but see Tradeoffs below), or other purposes.

Tradeoffs

Trust is irrevocable

A Section 2503(c) trust must be set up as an irrevocable trust. Once the trust is formed, a beneficiary named, and assets transferred to the trust, you lose the ability to alter or end the trust. For example, you cannot change the trust’s beneficiary.

You will incur costs to establish and maintain the trust

You will incur the costs to hire an experienced estate planning attorney to draft the trust document and transfer assets to the trust. You may also want to hire a professional trustee (a bank trust department or a professional fiduciary), in which case you will have to pay trustee fees each year. You may also have to pay to have tax returns prepared for the beneficiary of the trust and for the trust entity.

Because of the costs associated with establishing and maintaining a Section 2503(c) trust, it generally makes sense to do so only if you set up the account with a significant lump sum.

It is not generally advisable for the grantor to serve as trustee. If the grantor dies while serving as trustee, trust assets may be included in his or her gross estate for federal gift and estate tax purposes. Moreover, trust income may be taxed to the grantor under the grantor trust rules.

Negative impact on your child’s eligibility for financial aid

A 2503(c) trust is in your child’s name and thus included in your child’s assets when applying for financial aid. Under the federal financial aid methodology, a child is expected to contribute 20 percent of his or her assets toward college costs (parents are expected to contribute 5.6 percent of their assets). The more a child is expected to contribute, the less financial aid the child is likely to get.

Accumulated income and principal must be distributed or made available to the beneficiary when he or she reaches age 21

A Section 2503(c) must distribute accumulated income and principal to the beneficiary at age 21, even if the beneficiary is financially irresponsible. Alternatively, the trust document may grant the beneficiary the option to extend the trust term, though this does not guarantee that the beneficiary will actually do so.

How to do it

Hire attorney to draft trust Need a mortgage!!! A few minutes, a few clicks, up to 5 competing mortgage quotes

You should hire an experienced estate planning attorney to draft the Section 2503(c) trust document.

Transfer assets to the trust

Because you will incur costs to establish a Section 2503(c) trust, it usually makes sense to establish such a trust only if you can transfer a cost efficient amount to the trust. If you would like to transfer a more modest amount, it might make more sense to make a gift under the Uniform Transfers to Minors Act (UTMA) or under the Uniform Gifts to Minors Act (UGMA). Once a 2503(c) trust is established, you can make as many contributions to the trust as you like.

File annual tax return on behalf of trust

The trust will need to file a tax return and pay income taxes on the trust income that is earned but not distributed each year.

Distribute assets to child when child turns 21 (or as specified in trust)

The trustee must distribute the trust assets or make them available to the child when the child turns 21 (or as specified in the trust document).

Questions& Answers

The age of majority in your state is 18. Must the trust assets be distributed to your child then?

No. It does not matter when the child becomes an adult under state law. The only age-related requirement of a Section 2503(c) trust is that accumulated income and principal must pass to the beneficiary when he or she reaches age 21, unless the beneficiary elects to extend the term of the trust.

The Markets (as of market close February 23, 2024)

Stocks advanced last week, driven higher by tech shares that were bolstered by favorable corporate earnings reports. The Dow, the Nasdaq, and the S&P 500 posted weekly gains for the 16th time out of the last 18 trading weeks. Among the benchmark indexes listed here, only the small caps of the Russell 2000 closed the week in the red. Each of the 11 market sectors ended the week higher, led by consumer staples, materials, and health care. Bond prices ticked higher, pulling yields lower, with 10-year Treasuries slipping 3.0 basis points. The dollar slipped lower, while gold prices advanced. Crude oil prices fell over $3.00 per barrel. Generate Over $10,000 In Profit with the Recession Profit Secret System

Wall Street opened last Tuesday lower, dragged down by underperforming megacap technology stocks. The Russell 2000 fell 1.4%, followed by the Nasdaq (-0.9%), the S&P 500 (-0.6%), and the Dow (-0.2%), while the Global Dow was flat. Yields on 10-year Treasuries ticked lower to 4.27%. Crude oil prices edged down $0.92 to $78.27 per barrel. The dollar dipped to its lowest level in about two weeks. Gold prices advanced 0.6%.

Stocks got off to a slow start last Wednesday but were able to pare some of their early losses by the end of trading. The Dow, the Global Dow, and the S&P 500 ticked up 0.1%, while the Russell 2000 (-0.5%) and the Nasdaq (-0.3%) declined. Ten-year Treasury yields gained 5.0 basis points to reach 4.32%. Crude oil prices added $1.02 to close at about $78.06 per barrel. The dollar and gold prices declined.

Last Thursday saw an upbeat earnings report from a chip-making giant help drive stocks higher. The better-than-expected earnings results spurred investor optimism enough to drive both the S&P 500 (2.1%) and the Dow (1.2%) to new record highs, while the Nasdaq gained nearly 3.0%. The Global Dow advanced 1.1% and the Russell 2000 added 1.0% to round out the benchmark indexes listed here. The yield on 10-year Treasuries moved little, ending the session where it started at 4.32%. Crude oil prices gained nearly $0.50 to close at $78.38 per barrel. Gold prices and the dollar ended marginally lower.

Stocks were mixed last Friday, with the Global Dow (0.3%) gaining the most, while the Dow and the Russell 2000 inched up 0.2%. The S&P 500 ended the day flat. The tech-heavy Nasdaq couldn’t maintain the previous day’s momentum, sliding 0.3% by the close of trading. Ten-year Treasury yields fell 6.7 basis points to 4.26%. Crude oil prices dropped $2.00 per barrel. The dollar was flat, while gold prices rose 0.8%.

Stock Market Indexes

| Market/Index | 2023 Close | Prior Week | As of 2/23 | Weekly Change | YTD Change |

|---|---|---|---|---|---|

| DJIA | 37,689.54 | 38,627.99 | 39,131.53 | 1.30% | 3.83% |

| Nasdaq | 15,011.35 | 15,775.65 | 15,996.82 | 1.40% | 6.56% |

| S&P 500 | 4,769.83 | 5,005.57 | 5,088.80 | 1.66% | 6.69% |

| Russell 2000 | 2,027.07 | 2,032.74 | 2,016.69 | -0.79% | -0.51% |

| Global Dow | 4,355.28 | 4,443.56 | 4,515.13 | 1.61% | 3.67% |

| fed. funds target rate | 5.25%-5.50% | 5.25%-5.50% | 5.25%-5.50% | 0 bps | 0 bps |

| 10-year Treasuries | 3.86% | 4.29% | 4.26% | -3 bps | 40 bps |

| US Dollar-DXY | 101.39 | 104.28 | 103.96 | -0.31% | 2.53% |

| Crude Oil-CL=F | $71.30 | $79.25 | $76.56 | -3.39% | 7.38% |

| Gold-GC=F | $2,072.50 | $2,025.30 | $2,045.30 | 0.99% | -1.31% |

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments. Generate Over $10,000 In Profit with the Recession Profit Secret System

Last Week’s Economic News

- Existing-home sales grew by 3.1% in January, with sales accelerating in the Midwest, South, and West, while remaining steady in the Northeast. Despite the recent increase, sales were 1.7% under the January 2023 pace. Total housing inventory in January represented a 3.0-month supply, down slightly from the 3.1-month supply in December. The median existing-home price was $379,100 in January, down from $381,400 in December, but up from the January 2023 price of $360,800. Sales of single-family existing homes rose 3.4% last month but were 1.4% under the total from a year earlier. The median existing single-family home price was $383,500 in January, down from December’s $385,800, but well above the January 2023 price of $365,400.

- The national average retail price for regular gasoline was $3.269 per gallon on February 19, $0.077 per gallon higher than the prior week’s price but $0.110 per gallon less than a year ago. Also, as of February 19, the East Coast price increased $0.079 to $3.230 per gallon; the Midwest price rose $0.078 to $3.122 per gallon; the Gulf Coast price decreased $0.094 to $2.901 per gallon; the Rocky Mountain price advanced $0.131 to $2.922 per gallon; and the West Coast price increased $0.046 to $4.057 per gallon.

- For the week ended February 17, there were 201,000 new claims for unemployment insurance, a decrease of 12,000 from the previous week’s level, which was revised up by 1,000. According to the Department of Labor, the advance rate for insured unemployment claims for the week ended February 10 was 1.2%, a decrease of 0.1 percentage point from the previous week’s rate. The advance number of those receiving unemployment insurance benefits during the week ended February 10 was 1,862,000, a decrease of 27,000 from the previous week’s level, which was revised down by 6,000. States and territories with the highest insured unemployment rates for the week ended February 3 were New Jersey (2.9%), Rhode Island (2.7%), California (2.5%), Minnesota (2.5%), Massachusetts (2.4%), Illinois (2.2%), Alaska (2.1%), Montana (2.1%), Connecticut (2.0%), New York (2.0%), Pennsylvania (2.0%), and Washington (2.0%). The largest increases in initial claims for unemployment insurance for the week ended February 10 were in Kentucky (+3,264), California (+2,053), Nevada (+364), Maryland (+290), and Washington (+91), while the largest decreases were in Missouri (-3,519), Pennsylvania (-1,477), Texas (-1,431), Illinois (-1,213), and Oregon (-941).

Eye on the Week Ahead

This week is loaded with important, market-moving economic information. The second estimate of the fourth-quarter gross domestic product is available. The initial release had the economy accelerating at an annualized rate of 3.3%. The January report on personal income and outlays is also out at the end of this week. Most investors will be focused on the personal consumption expenditures price index, a measure of inflation favored by the Federal Reserve. Prices advanced 0.2% in December. However, January has seen other inflation indicators accelerate at a rate higher than expected, so it is likely the same will hold true for the PCE price index.

Data sources: Economic: Based on data from U.S. Bureau of Labor Statistics (unemployment, inflation); U.S. Department of Commerce (GDP, corporate profits, retail sales, housing); S&P/Case-Shiller 20-City Composite Index (home prices); Institute for Supply Management (manufacturing/services). Performance: Based on data reported in WSJ Market Data Center (indexes); U.S. Treasury (Treasury yields); U.S. Energy Information Administration/Bloomberg.com Market Data (oil spot price, WTI, Cushing, OK); www.goldprice.org (spot gold/silver); Oanda/FX Street (currency exchange rates). Generate Over $10,000 In Profit with the Recession Profit Secret System

News items are based on reports from multiple commonly available international news sources (i.e., wire services) and are independently verified when necessary with secondary sources such as government agencies, corporate press releases, or trade organizations. All information is based on sources deemed reliable, but no warranty or guarantee is made as to its accuracy or completeness. Neither the information nor any opinion expressed herein constitutes a solicitation for the purchase or sale of any securities, and should not be relied on as financial advice. Forecasts are based on current conditions, subject to change, and may not come to pass. U.S. Treasury securities are guaranteed by the federal government as to the timely payment of principal and interest. The principal value of Treasury securities and other bonds fluctuates with market conditions. Bonds are subject to inflation, interest-rate, and credit risks. As interest rates rise, bond prices typically fall. A bond sold or redeemed prior to maturity may be subject to loss. Past performance is no guarantee of future results. All investing involves risk, including the potential loss of principal, and there can be no guarantee that any investing strategy will be successful.

The Dow Jones Industrial Average (DJIA) is a price-weighted index composed of 30 widely traded blue-chip U.S. common stocks. The S&P 500 is a market-cap weighted index composed of the common stocks of 500 largest, publicly traded companies in leading industries of the U.S. economy. The NASDAQ Composite Index is a market-value weighted index of all common stocks listed on the NASDAQ stock exchange. The Russell 2000 is a market-cap weighted index composed of 2,000 U.S. small-cap common stocks. The Global Dow is an equally weighted index of 150 widely traded blue-chip common stocks worldwide. The U.S. Dollar Index is a geometrically weighted index of the value of the U.S. dollar relative to six foreign currencies. Market indexes listed are unmanaged and are not available for direct investment.

Embarking on the entrepreneurial journey is a path filled with excitement, challenges, and the promise of freedom and financial rewards. Whether you’re considering launching a startup, buying an existing business, or investing in a franchise, understanding the nuances of each option is crucial for success. This guide delves into the critical aspects of starting or buying a business, offering insights and strategies to navigate the entrepreneurial landscape effectively.

Starting from Scratch: The Allure and Challenges of Start-ups

The Start-up Appeal

Start-ups are synonymous with innovation and creativity, offering the thrilling opportunity to bring a new idea to life. For aspiring entrepreneurs with a unique business concept or a desire to enter a familiar market with a fresh approach, start-ups represent the ultimate canvas for entrepreneurial expression.

Navigating the Start-up Risks

The path of a start-up is fraught with uncertainties. Without an existing track record, entrepreneurs must rely on their vision, resilience, and strategic planning to carve out their market niche. The journey involves meticulous market research, identifying customer needs, and developing a viable product or service that stands out from the competition.

The Crucial Role of a Business Plan

A robust business plan is the cornerstone of any successful start-up. This document not only serves as a roadmap for the business’s growth but also as a persuasive tool to secure financing from banks or investors. Key components include: Click and see how GlucoFence can help you.

can help you.

- Executive Summary: A compelling snapshot of your business idea and its potential for success.

- Market Analysis: Insight into your target market, customer demographics, and competitive landscape.

- Financial Projections: Detailed forecasts of revenue, expenses, and profitability to demonstrate the financial viability of your venture.

Buying an Existing Business: Leveraging a Legacy of Success

The Advantage of Proven Performance

Purchasing an existing business offers the immediate benefit of a proven business model. This option reduces the risk associated with unknown market reactions and provides a clearer picture of potential financial returns. Moreover, an established customer base and operational systems can accelerate growth compared to starting from scratch.

Due Diligence is Key

However, the process of buying a business demands thorough due diligence. Prospective buyers must scrutinize the business’s financial statements, understand its market position, and assess any liabilities that might come with the purchase. It’s also vital to understand the reason behind the sale to avoid inheriting unforeseen challenges.

Transitioning Ownership

A smooth transition is crucial for maintaining the business’s operational stability and retaining its clientele. Negotiating a transition period where the previous owner provides guidance and support can facilitate a smoother changeover and help preserve the business’s goodwill.

Franchising: A Blend of Independence and Support

The Franchise Formula

Franchising offers a middle ground between starting from scratch and buying an existing business. By purchasing a franchise, entrepreneurs get access to a proven business model, brand recognition, and ongoing support from the franchisor in areas like marketing and operational strategy.

Understanding the Franchise Agreement

It’s essential to thoroughly review the franchise agreement and understand the terms, including fees, territorial rights, and operational guidelines. Prospective franchisees should conduct extensive research, speak with current and former franchisees, and consider the franchisor’s reputation before committing.

Funding Your Business Venture

Securing Startup Capital