The Dream of College Education

For most parents, the dream of sending their child to college is a paramount goal. It represents not just an academic achievement but also a stepping stone to a brighter future. However, as many families realize, a college diploma comes with a hefty price tag. For those not in a strong financial position, the prospect of paying for college can be daunting. The key to managing this challenge lies in early preparation and strategic planning.

Protect your online activity with Nord VPN try it now!

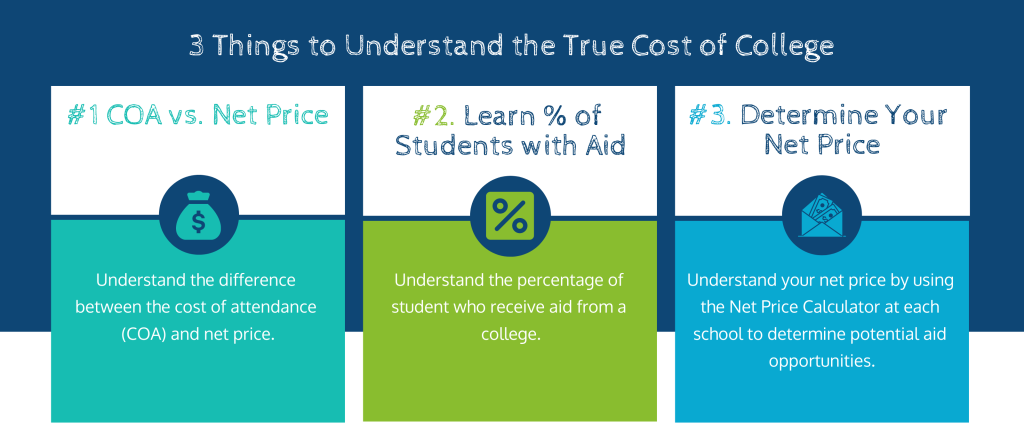

Understanding College Costs

The Rising Cost of Higher Education

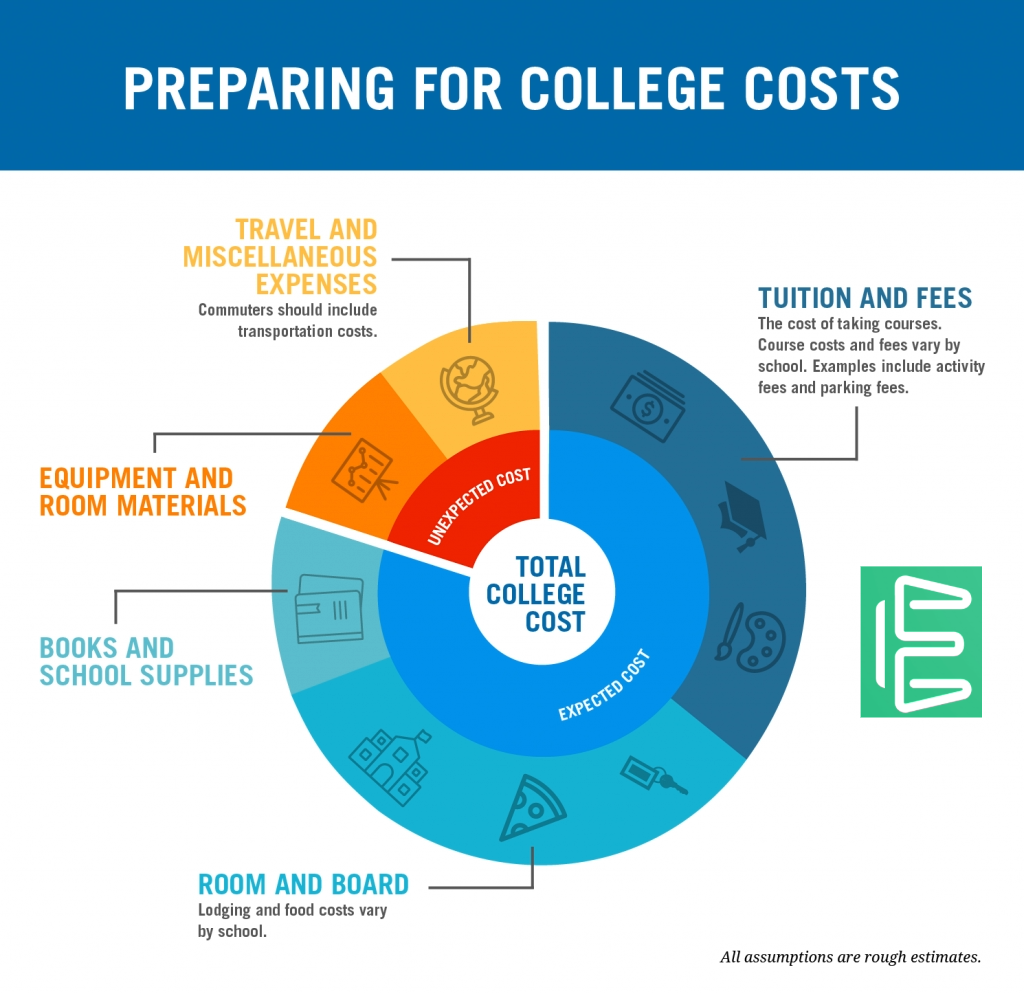

As of the 2023–2024 academic year, the average annual cost of college attendance varies significantly:

- $28,840 for four-year public colleges (in-state students)

- $46,730 for four-year public colleges (out-of-state students)

- $60,420 for four-year private colleges

Protect your online activity with Nord VPN try it now!

These figures include tuition, fees, room, board, books, transportation, and personal expenses. It’s important to note that these costs are likely to continue rising, typically between 3% and 6% annually, in line with historical trends (Source: College Board, Trends in College Pricing and Student Aid 2023).

Preparing Financially for College

Starting Early: The Power of Saving

The most effective strategy for managing college expenses is to start saving as early as possible. Even if you can only set aside a small amount initially, it can significantly impact the long run. A comprehensive savings plan should include estimating the total cost for four years of college and determining how much of that cost you aim to cover. Utilize financial calculators to work out monthly savings goals.

Protect your online activity with Nord VPN try it now!

Diverse Funding Sources

Many parents find they cannot save the full cost of their child’s education in advance. Typically, they save enough for an initial down payment on college expenses and then use a combination of the following to cover the rest:

- Current income

- Federal Direct PLUS Loans

- Private loans, such as home equity loans

- Investments (mutual funds, 401(k)s, IRAs)

- Federal and college financial aid (loans, grants, scholarships, work-study)

- The child’s savings or earnings from part-time jobs

- Gifts from relatives

Budgeting and Cutting Costs

To increase your savings, consider these strategies:

- Cut nonessential spending

- Reduce standard of living (e.g., own one car, dine out less)

- Add unexpected windfalls to the college fund

- Increase income through current or new employment

- Encourage spouse’s return to workforce if feasible

- Request contributions from relatives instead of gifts

Protect your online activity with Nord VPN try it now!

Starting a Savings Program Early

Despite the financial strains of new parenthood, starting a college savings plan early is crucial. When your child is young, you have the advantage of time, which allows for investments that may outpace the rise in college costs. Compounding interest and regular investments over many years can accumulate significantly in a college fund. Even if you start with as little as $25 or $50 a month, you’re creating a foundation that can grow over time.

Remember, the path to financing your child’s college education is not a sprint but a marathon. Starting early, staying consistent, and exploring all available financial avenues will make this dream a more achievable reality for your family.